What is there to know about the solar tax credit extension, and what is its pre-forecasted impact on homeowners? The extension profoundly impacts homeowners as you can save energy, money, and time, specifically regarding the window to submit the claim for the tax credit after installing solar panels and over the next ten years—regarding energy and money savings.

However, while there’s no income cap on claiming the solar tax credit, it’s only eligible for one claim unless you own more than one solar-powered property. And owning multiple solar-powered properties can increase your amount of taxes owed. If you want to learn more about solar power for your home and get in on the tax credit, keep reading this complete guide to the solar tax credit extension.

Can You Elaborate On the Solar Tax Credit?

Like most renewable energy sources, solar power has its own credit that residential property owners can claim on their taxes. However, this tax credit doesn’t increase your refund; it goes into the percentage of what you paid for installing the solar power system.

This year is a good time to consider installing solar panels and claiming a tax credit that applies to a percentage of the solar panel installation. Homeowners who installed, and plan to install, solar power between 2022 and 2032, can receive a rate, but it will decrease over time and completely disappear by 2035 when the congressional act ends.

Any time before December 31, 2022, eligible homeowners can receive 30% back from the solar tax incentive. In 2033, eligible homeowners can receive 26% back, which drops to only 22% in 2034, and zero percent in 2035.

This Tax Credit Sounds Exciting, but Am I Eligible?

Eligibility for this tax credit is simple, but sometimes it can be unclear. Here’s a straightforward list of criteria to help you determine if you’re eligible to claim the tax credit, followed by more questions you might have on eligibility.

- The only residential property owners eligible for this tax credit are those who installed their solar panels between January 1, 2017, and December 31, 2034.

- The solar panel system is on a property the homeowner owns and doesn’t lease.

- The solar panel system is 100% yours, and you don’t purchase electricity from a solar power company.

- Homeowners moving into a home with previously installed solar panels can claim the original installation and the tax credit if there is no claim associated with the property.

Are There Expenses Included in the Tax Credit?

Yes, there are expenses included in the tax credit. The following is eligible to be allocated to the tax credit claim:

- Labor costs

- Additional equipment costs

- Sales taxes

- Energy storage costs

Have I Been Disqualified if My Solar Panels Aren’t on the Roof?

No, you’re not disqualified at all. The common misconception is that residential property owners believe solar panels only go on the roof. While putting solar panels on the roof is commonplace, it’s not the only location eligible for this incentive. You can put solar panels on a deck, in the backyard, or along a pathway from the driveway to the entrance of your home. If you install the panels and use them, you qualify.

Can I Still Claim the Solar Tax Credit Without Installing Solar Panels?

No, you cannot claim the solar tax credit if you don’t install solar panels before the end of the year. When speaking with someone about installing solar panels on your home, remember this: you can still claim the solar tax credit if you plan your solar panel installation by the end of 2034.

How Do I Claim the Solar Tax Credit?

Claiming this tax credit requires filing form 5695 with the IRS. This form has sections for commercial and residential solar power, so you’ll need to file 25D—this allows the credit to be applied to personal income taxes. Although the full amount isn’t refundable, it does roll over for five years, which you can use later, and has the chance to come out as a refund at the end of the year if there was an overpayment.

Can You Claim This More Than Once?

No, you can only claim the solar tax once unless you have installed new solar panel systems on multiple properties you own. Don’t worry—your taxes will reflect this tax if you’ve already claimed it, and if there is no record, your tax filer can assist you with the filing process.

Are There Other Tax Benefits?

Yes, through your state or local government. Many states have programs to reduce installation costs and cover other expenses. There’s also additional funding available to satisfy leftover fees. Contact your local or state government office to find out about financing and other tax incentives when you are ready to install your solar panel system.

Why Should I Install Solar Panels?

Installing solar panels isn’t only great for the tax incentive, but it helps the environment. By installing a solar panel system that generates free energy directly from the sun, you give yourself a break from paying more than you want in electric bills.

More Benefits of a Solar Panel System

Earning more in savings and increasing your home value on top of claiming the solar tax credit are just two possible benefits of installing a solar panel system. You and your family can also enjoy the following amazing benefits:

- Affordable installation

- Reduction in electric and energy bills

- A modern home

- More diverse applications to create solar power

If our complete guide to the solar power tax credit extension has helped you, share it with a neighbor, friend, or family member to help in their decision to switch from the traditional electrical grid to a solar panel control network.

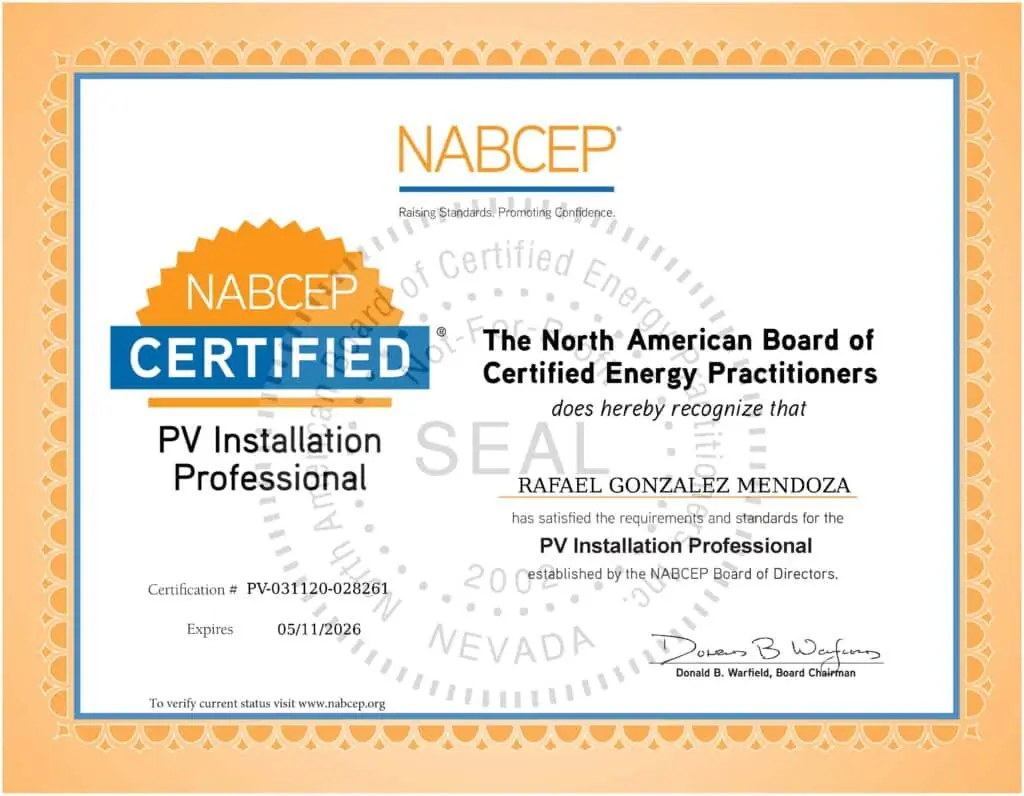

Solar energy’s an incredible form of electricity that’s better for the planet and helps you save money. If you’re looking for a high-quality solar panel installation by a values-based team, go with Go Solar Power. Get a free quote and schedule your future installation today with our certified solar system installers, so you can start saving more and claim exciting tax incentives.